New Zealand is considered to be one of the fastest-emerging and ideal study destinations for students aspiring for a quality education, with affordable tuition fees. Also, New Zealand is one of the safest countries in the world – ranked second in the Global Peace Index for 2021 and growing enormously in terms of research and development.

The New Zealand Education system is progressive, as well as much more affordable offering state-of-the-art facilities. In addition, New Zealand universities and their qualifications are highly recognized and regarded by employers across the globe.

New Zealand is also known for its beautiful scenic beauty and adventure sports. The country majorly includes two main islands – the North and South Islands, and a number of tiny islands, some of which are hundreds of miles away from the main group. The capital of New Zealand is Wellington, and the largest urban area is Auckland; both are located on the North Island. Moreover, Auckland is considered one of the world’s most liveable cities, ranking first in the 2021 Quality of Living survey conducted annually by the global HR consultants Mercer.

English, Māori, and New Zealand Sign Language are the official languages, with English being predominant and thus majorly spoken throughout the country.

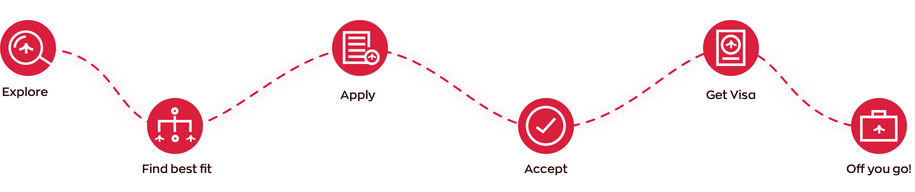

It is recommended that students aspiring to study abroad take a deep dive into the entire journey, from the preparation, the courses and the admission process, to the paperwork and the visas.

Here you’ll find out more about top universities, top courses and reasons to study in New Zealand.

| Top Courses | Price Range(NZD) |

|---|---|

| Hospitality and Tourism | 18,000 - 35,500 |

| Business studies | 22,500 - 45,000 |

| IT and Computer Science | 24,000 - 51,000 |

| Cyber Security | 17,852 -50,000 |

| Health Sciences | 22,600 - 45,000 |

| Animation | 19,800 - 39,000 |

| Arts and Humanities | 23,000 - 45,000 |

Avg Living costs / per year

16,000 - 20,000

Avg Tuition Fee/Year

Undergraduate programs-22,000 - 32,000

Postgraduate programs:26,000-40,000

MBA:31,000-60,000

Indian students

20,000+

International students

100,000+

Avg graduate

incomes / Year

49,000 - 73,000

Migration possibility

YES

Intakes

Feb, July (with few universities offering multiple intakes in September and November)

Scholarships Available

YES

Students aspiring to study abroad often find it hard to select the country and the university matching their interests and budget. However, if a student is willing to experience quality education with affordable tuition fees, then New Zealand is a fast emerging and an ideal study destination for them. Also, New Zealand is growing enormously in terms of research and development. Moreover, the universities of New Zealand are globally recognized and they cater to the personal needs of the student in the class.

Overall, the benefits of studying in New Zealand are as follows:

The Visa management process starts as soon as the student receives the unconditional offer letter from the university along with a valid English Language Proficiency Test score (IELTS, PTE, TOEFL).TC Global follows a well-documented method for Visa Applications. You can start the Visa process for New Zealand a maximum of 120 days before the course/program start date. The student needs to undergo Medical and Police Clearance Certificate (PCC) before applying for the New Zealand visa.

Moreover, preparing for a New Zealand visa application varies in complexity. For the visas, you'll need to get all the evidence together before you submit your application. Mostly, visas can be applied online. Others can be sent through us along with the application forms, passport, and other supporting documents. We will then assess the documents, prepare the visa file, put a covering letter/summary, and forward it to New Zealand High Commission through TT Services New Delhi along with the DD of visa fees.

The visa interview is the final stage of the application process, where one of the Consular Officers will be responsible for asking questions to assess the applications. The New Zealand High Commission will then assess your application and enclosed documents and give decisions like AIP (Approval In Principle) in approx 2 to 4 weeks.

Our Visa team is fully equipped and experienced to guide you through the process. Please connect with our Relationships team and our Visa team, should you need any assistance with your student Visa.

New Zealand is considered as an ideal study abroad destination for Indian students due to its lower annual tuition fees and low cost of living for many courses.The living expenses in New Zealand are cheaper than any other study abroad destinations like Canada, the UK, the U.S, and Australia. Approximate Cost of the Course at Universities:

Approximate Cost of Living: NZ$16,000 - NZ$20,000 per annum

Some of the courses which are in demand in New Zealand are:

Privileged and confidential

Terms of Use | August 24 2021

PLEASE READ THESE TERMS OF USE CAREFULLY BEFORE USING THE SERVICES OFFERED BY TC GLOBAL. THESE TERMS OF USE SET FORTH THE LEGALLY BINDING TERMS AND CONDITIONS FOR YOUR USE OF THE WEBSITE AT https://tcglobal.com ("THE "SITE") AND THE SERVICES, FEATURES, CONTENT, APPLICATIONS OR WIDGETS OFFERED BY TC GLOBAL ("SERVICE").

For the purposes of these Terms of Use, "TC Global" shall be deemed to include The Chopras Global Holdings Pte Ltd and/or its affiliates.

Acceptance of Terms

By registering for and/or using the Service in any manner, including but not limited to visiting or browsing the Site, you agree to all of the terms and conditions contained herein ("Terms of Use") and all other operating rules, policies and procedures that may be published from time to time on the Site by TC Global, each of which is incorporated by reference and each of which may be updated by TC Global from time to time without notice to you in accordance with the terms set out under the "Modification of Terms of Use" section below. In addition, some services offered through the Service may be subject to additional terms and conditions specified by TC Global from time to time; your use of such services is subject to those additional terms and conditions, which are incorporated into these Terms of Use by this reference. These Terms of Use apply to all users of the Service, including, without limitation, users who are contributors of content, information, and other materials or services on the Site, individual users of the Service, venues that access the Service, and users that have a page on the Service.

Access

Subject to these Terms of Use, TC Global may offer to provide the Services, as described more fully on the Site, and which are selected by you, solely for your own use, and not for the use or benefit of any third party. Services shall include, but not be limited to, any services TC Global performs for you, any applications or widgets offered by TC Global that you download from the Site or, subject to the terms set out under the "Third party Sites and Services" section below, from third party application stores (eg. App Store, Play Store or Google Apps Marketplace) authorized by TC Global, as well as the offering of any materials displayed or performed on or through the Services (including Content (as defined below)).

Registration and Eligibility

You are required to register with TC Global to browse the Site, view Content and access the Services only and represent, warrant and covenant that you provide TC Global with accurate and complete registration information (including, but not limited to a user name ("User Name"), e-mail address and/or mobile telephone number and a password you will use to access the Service) and to keep your registration information accurate and up-to-date. Failure to do so shall constitute a breach of these Terms of Use, which may result in immediate termination of your TC Global account. We recommend, but do not require, that you use your own name as your User Name so your contacts can recognize you more easily. You shall not:

TC Global reserves the right to refuse registration of, or cancel a User Name at its sole discretion. You are solely responsible and liable for activity that occurs on your account and shall be responsible for maintaining the confidentiality of your TC Global password. You shall never use another user's account without such other user's prior express permission. You will immediately notify TC Global in writing of any unauthorized use of your account, or other account related security breach of which you are aware.

You represent and warrant that if you are an individual, you are of legal age to form a binding contract, or that if you are registering on behalf of an entity or a minor, that you are lawfully authorized to enter into, and bind the entity or yourself (as the legal guardian of the minor) to, these Terms of Use and register for the Service. The Service is not available to individuals who are younger than 10 years old. TC Global may, in its sole discretion, refuse to offer the Service to any person or entity and change its eligibility criteria at any time.

You are solely responsible for ensuring that these Terms of Use are in compliance with all laws, rules and regulations applicable to you and the right to access the Service is revoked where these Terms of Use or use of the Service is prohibited and, in such circumstances, you agree not to use or access the Site or Services in any way.

If you use a mobile device, please be aware that your carrier's normal rates and fees, such as text messaging and data charges, will still apply. In the event you change or deactivate your mobile telephone number, you agree that you will update your account information on the Services within 48 hours to ensure that your messages are not sent to the person who acquires your old number.

Content

All Content, whether publicly posted or privately transmitted, is the sole responsibility of the person who originated such Content. TC Global cannot guarantee the authenticity of any Content or data which users may provide about themselves. You acknowledge that all Content accessed by you using the Service is at your own risk and you will be solely responsible and liable for any damage or loss to you or any other party resulting therefrom. For purposes of these Terms of Use, the term "Content" includes, without limitation, any location information, video clips, audio clips, responses, information, data, text, photographs, software, scripts, graphics, and interactive features generated, provided, or otherwise made accessible by TC Global on or through the Service. Content added, created, uploaded, submitted, distributed, posted or otherwise obtained through the Service by users, including Content that is added to the Service in connection with users linking their accounts to third party websites and services, is collectively referred to as, "User Submissions".

TC Global Content

The Service contains Content specifically provided by TC Global or its partners and such Content is protected by copyrights, trademarks, service marks, patents, trade secrets or other proprietary rights and laws, as applicable. You shall abide by and maintain all copyright notices, information, and restrictions contained in any Content accessed through the Service.

Subject to these Terms of Use, TC Global grants each user of the Site and/or Service a worldwide, non-exclusive, non-sub licensable and non-transferable license to use, modify and reproduce the Content, solely for personal, non-commercial use. Use, reproduction, modification, distribution or storage of any Content for other than personal, non-commercial use is expressly prohibited without prior written permission from TC Global, or from the copyright holder identified in such Content's copyright notice, as applicable. You shall not sell, license, rent, or otherwise use or exploit any Content for commercial (whether or not for profit) use or in any way that violates any third party right.

User Submissions

We may use your User Submissions in a number of different ways in connection with the Site, Service and TC Global's business as TC Global may determine in its sole discretion, including but not limited to, publicly displaying it, reformatting it, incorporating it into marketing materials, advertisements and other works, creating derivative works from it, promoting it, distributing it, and allowing other users to do the same in connection with their own websites, media platforms, and applications ("Third Party Media"). By submitting User Submissions on the Site or otherwise through the Service, you hereby do and shall grant TC Global a worldwide, non- exclusive, royalty-free, fully paid, sub licensable and transferable license to use, copy, edit, modify, reproduce, distribute, prepare derivative works of, display, perform, and otherwise fully exploit the User Submissions in connection with the Site, the Service and TC Global's (and its successors and assigns') business, including without limitation for promoting and redistributing part or all of the Site (and derivative works thereof) or the Service in any media formats and through any media channels (including, without limitation, third party websites and feeds). You also hereby do and shall grant each user of the Site and/or the Service, including Third Party Media, a non-exclusive license to access your User Submissions through the Site and the Service, and to use, edit, modify, reproduce, distribute, prepare derivative works of, display and perform such User Submissions in connection with their use of the Site, Service and Third Party Media. For clarity, the foregoing license grant to TC Global does not affect your other ownership or license rights in your User Submission(s), including the right to grant additional licenses to the material in your User Submission(s), unless otherwise agreed in writing with TC Global.

You represent and warrant that you have all rights to grant such license to us without infringement or violation of any third party rights, including without limitation, any privacy rights, publicity rights, copyrights, contract rights, or any other intellectual property or proprietary rights.

You understand that all information publicly posted or privately transmitted through the Site is the sole responsibility of the person from whom such Content originated; that TC Global will not be liable for any errors or omissions in any Content; and that TC Global cannot guarantee the identity of any other users with whom you may interact in the course of using the Service.

You should be aware that the opinions expressed in the Content in User Submissions are theirs alone and do not reflect the opinions of TC Global. TC Global is not responsible for the accuracy of any of the information supplied in User Submissions or in relation to any comments that are posted.

You should bear in mind that circumstances change and that information that may have been accurate at the time of posting will not necessarily remain so.

When you delete your User Submissions, they will be removed from the Service. However, you understand that any removed User Submissions may persist in backup copies for a reasonable period of time (but following removal will not be shared with others) or may remain with users who have previously accessed or downloaded your User Submissions.

Rules and Conduct

As a condition of use, you promise not to use the Service for any purpose that is prohibited by these Terms of Use. You are responsible for all of your activity in connection with the Service.

Additionally, you shall abide by all applicable local, state, national and international laws and regulations and, if you represent a business, any advertising, marketing, privacy, or other self-regulatory code(s) applicable to your industry.

By way of example, and not as a limitation, you shall not (and shall not permit any third party to) either (a)take any action or (b)upload, download, post, submit or otherwise distribute or facilitate distribution of any Content on or through the Service, including without limitation any User Submission, that:

Additionally, you agree not to:

TC Global does not guarantee that any Content or User Submissions (as defined above) will be made available on the Site or through the Service. TC Global has no obligation to monitor the Site, Service, Content, or User Submissions. However, TC Global reserves the right to (i) remove, suspend, edit or modify any Content in its sole discretion, including without limitation any User Submissions at any time, without notice to you and for any reason (including, but not limited to, upon receipt of claims or allegations from third parties or authorities relating to such Content or if TC Global is concerned that you may have violated these Terms of Use), or for no reason at all and (ii) to remove, suspend or block any User Submissions from the Service. TC Global also reserves the right to access, read, preserve, and disclose any information as TC Global reasonably believes is necessary to (i) satisfy any applicable law, regulation, legal process or governmental request, (ii) enforce these Terms of Use, including investigation of potential violations hereof, (iii) detect, prevent, or otherwise address fraud, security or technical issues, (iv) respond to user support requests, or (v) protect the rights, property or safety of TC Global, its users and the public.

Technical Failures

It is possible that you may face disruptions, including, but not limited to errors, disconnections or interferences in communication in the internet services, software or hardware that you have used to avail our Service. TC Global is not responsible for such factors in the disruption or interruption in the Service and you take full responsibility with complete knowledge for any risk of loss or damages caused due to interruption of services for any such reasons.

Advertisements, Third Party Sites and Services

Some of the TC Global Services are supported by advertising revenue and may display advertisements, promotions, and links to third-party websites. You hereby agree that TC Global may place such advertising and promotions on the TC Global Services or on, about, or in conjunction with your Content. The manner, mode and extent of such advertising and promotions are subject to change without specific notice to you.

The Service may permit you to link to other websites, services or resources on the Internet, and other websites, services or resources may contain links to the Site. When you access third party websites, you do so at your own risk. These other websites are not under TC Global's control, and you acknowledge that TC Global is not responsible or liable for the content, functions, accuracy, legality, appropriateness or any other aspect of such websites or resources. The inclusion of any such link does not imply endorsement by TC Global or any association with its operators. You further acknowledge and agree that TC Global shall not be responsible or liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any such Content, goods or services available on or through any such website or resource.

Termination

TC Global may terminate your access to all or any part of the Service at any time, with or without cause, with or without notice, effective immediately, which may result in the forfeiture and destruction of all information associated with your membership. If you wish to terminate your account, you may do so by contacting us at hello@tcglobal.com till we develop the procedure on the website and apps. Any fees paid hereunder are non-refundable. All provisions of these Terms of Use which by their nature should survive termination shall survive termination, including, without limitation, ownership provisions, warranty disclaimers, indemnity and limitations of liability.

Warranty Disclaimer

Save to the extent required by law, TC Global has no special relationship with or fiduciary duty to you. You acknowledge that TC Global has no control over, and no duty to take any action regarding: which users gain access to the Service; what Content you access via the Service; what effects the Content may have on you; how you may interpret or use the Content; or what actions you may take as a result of having been exposed to the Content.

You release TC Global from all liability for you having acquired or not acquired Content through the Service. The Service may contain, or direct you to websites containing, information that some people may find offensive or inappropriate. TC Global makes no representations concerning any Content contained in or accessed through the Service, and TC Global will not be responsible or liable for the accuracy, copyright compliance, legality or decency of material contained in or accessed through the Service and cannot be held liable for any third-party claims, losses or damages.

You release us from all liability relating to your connections and relationships with other users. You understand that we do not, in any way, screen users, nor do we inquire into the backgrounds of users or attempt to verify their backgrounds or statements. We make no representations or warranties as to the conduct of users or the veracity of any information users provide. In no event shall we be liable for any damages whatsoever, whether direct, indirect, general, special, compensatory, consequential, and/or incidental, arising out of or relating to the conduct of you or anyone else in connection with the Services, including, without limitation, bodily injury, emotional distress, and any damages resulting in any way from communications or meetings with users or persons you may otherwise meet through the Services. As such, you agree to take reasonable precautions and exercise the utmost personal care in all interactions with any individual you come into contact with through the Service,

particularly if you decide to meet such individuals in person. For example, you should not, under any circumstances, provide your financial information (e.g., credit card or bank account numbers) to other individuals.

THE SITE, SERVICE AND CONTENT ARE PROVIDED "AS IS", "AS AVAILABLE" AND ARE PROVIDED WITHOUT ANY REPRESENTATIONS OR WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, THE IMPLIED WARRANTIES OF TITLE, NONINFRINGEMENT, MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE, AND ANY WARRANTIES IMPLIED BY ANY COURSE OF PERFORMANCE OR USAGE OF TRADE, ALL OF WHICH ARE EXPRESSLY DISCLAIMED, SAVE TO THE EXTENT REQUIRED BY LAW.

TC GLOBAL, AND ITS AFFILIATES, TEAM, DIRECTORS, EMPLOYEES, AGENTS, REPRESENTATIVES, SUPPLIERS, PARTNERS AND CONTENT PROVIDERS DO NOT WARRANT THAT: (A) THE SERVICE WILL BE SECURE OR AVAILABLE AT ANY PARTICULAR TIME OR LOCATION; (B) ANY DEFECTS OR ERRORS WILL BE CORRECTED; (C) ANY CONTENT OR SOFTWARE AVAILABLE AT OR THROUGH THE SERVICE IS FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS; OR (D) THE RESULTS OF USING THE SERVICE WILL MEET YOUR REQUIREMENTS. YOUR USE OF THE WEBSITE, SERVICE AND CONTENT IS SOLELY AT YOUR OWN RISK. SOME STATES / COUNTRIES DO NOT ALLOW LIMITATIONS ON IMPLIED WARRANTIES, SO THE ABOVE LIMITATIONS MAY NOT APPLY TO YOU.

Indemnification

You shall defend, indemnify, and hold harmless TC Global, its affiliates and each of its and its affiliates' employees, contractors, directors, suppliers and representatives from all losses, costs, actions, claims, damages, expenses (including reasonable legal costs) or liabilities, that arise from or relate to your use or misuse of, or access to, the Site, Service, Content or otherwise from your User Submissions, violation of these Terms of Use, or infringement by you, or any third party using the your account, of any intellectual property or other right of any person or entity (save to the extent that a court of competent jurisdiction holds that such claim arose due to an act or omission of TC Global). TC Global reserves the right to assume the exclusive defense and control of any matter otherwise subject to indemnification by you, in which event you will assist and cooperate with TC Global in asserting any available defenses.

Limitation of Liability

ALL LIABILITY OF TC GLOBAL, ITS AFFILIATES, DIRECTORS, EMPLOYEES, AGENTS, REPRESENTATIVES, PARTNERS, SUPPLIERS OR CONTENT PROVIDERS HOWSOEVER ARISING FOR ANY LOSS SUFFERED AS A RESULT OF YOUR USE OF THE SITE, SERVICE, CONTENT OR USER SUBMISSIONS IS EXPRESSLY EXCLUDED TO THE FULLEST EXTENT PERMITTED BY LAW, SAVE THAT, IF A COURT OF COMPETENT JURISDICTION DETERMINES THAT LIABILITY OF TC GLOBAL, ITS DIRECTORS, EMPLOYEES, AGENTS, REPRESENTATIVES, PARTNERS, SUPPLIERS OR CONTENT PROVIDERS (AS APPLICABLE) HAS ARISEN, THE TOTAL OF SUCH LIABILITY SHALL BE LIMITED IN AGGREGATE TO THE VALUE OF TC GLOBAL'S SERVICES AVAILED BY THE USER FOR 12 MONTHS PRIOR TO THE INITIATION OF A CLAIM.

TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, IN NO EVENT SHALL TC GLOBAL, NOR ITS DIRECTORS, EMPLOYEES, AGENTS, REPRESENTATIVES, PARTNERS, SUPPLIERS OR CONTENT PROVIDERS, BE LIABLE UNDER CONTRACT, TORT, STRICT LIABILITY, NEGLIGENCE OR ANY OTHER LEGAL OR EQUITABLE THEORY OR OTHERWISE (AND WHETHER OR NOT TC GLOBAL, ITS DIRECTORS, EMPLOYEES, AGENTS, REPRESENTATIVES, PARTNERS, SUPPLIERS OR CONTENT PROVIDERS HAD PRIOR KNOWLEDGE OF THE CIRCUMSTANCES GIVING RISE TO SUCH LOSS OR DAMAGE) WITH RESPECT TO THE SITE, SERVICE, CONTENT OR USER SUBMISSIONS FOR:

NOTHING IN THESE TERMS OF USE SHALL BE DEEMED TO EXCLUDE OR LIMIT YOUR LIABILITY IN RESPECT OF ANY INDEMNITY GIVEN BY YOU UNDER THESE TERMS OF USE. APPLICABLE LAW MAY NOT ALLOW THE LIMITATION OR EXCLUSION OF LIABILITY OR INCIDENTAL OR CONSEQUENTIAL DAMAGES, SO THE ABOVE LIMITATION OR EXCLUSION MAY NOT APPLY TO YOU. IN SUCH CASES, TC GLOBAL'S LIABILITY WILL BE LIMITED TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW.

Governing Law

A printed version of these Terms of Use and of any notice given in electronic form shall be admissible in judicial or administrative proceedings based upon or relating to these Terms of Use to the same extent and subject to the same conditions as other business documents and records originally generated and maintained in printed form. You and TC Global agree that any cause of action arising out of or related to the Service must commence within one (1) year after the cause of action arose; otherwise, such cause of action is permanently barred.

Terms of Use and all other policies available on this Service shall be interpreted and construed in accordance with the laws of India. Any dispute arising out of or in connection with these Terms of Use and/ or other policies available on this App, including any question regarding its existence, validity or termination, shall be referred to and finally resolved by arbitration administered by the Singapore International Arbitration Centre ("SIAC") in accordance with the Arbitration Rules of the Singapore International Arbitration Centre ("SIAC Rules") for the time being in force, which rules are deemed to be incorporated by reference in this clause. The Tribunal shall consist of 3 arbitrators. The seat and venue of Arbitration shall be Singapore and the language of proceedings shall be English. Subject to the foregoing, the Courts of Singapore shall have exclusive jurisdiction over any disputes relating to the subject matter, herein.

Notwithstanding the foregoing, if a dispute arises with respect to the validity, scope, enforceability, inventorship, ownership, infringement, breach or unauthorised use of any patent, trademark, copyright or other intellectual property right or any non-proprietary data owned and/or controlled by TC Global, whether or not arising from the Terms of Use, such dispute (at the option of TC Global) shall not be submitted to arbitration and instead, TC Global shall be free to initiate litigation, including but not limited to a claim for interim injunctive relief, in a court of competent jurisdiction, in any country or other jurisdiction in which such rights apply.

Integration and Severability

These Terms of Use are the entire agreement between you and TC Global with respect to the Service and use of the Site, Service, Content or User Submissions, and supersede all prior or contemporaneous communications and proposals (whether oral, written or electronic) between you and TC Global with respect to the Site. If any provision of these Terms of Use is found to be unenforceable or invalid, that provision will be limited or eliminated to the minimum extent necessary so that these Terms of Use will otherwise remain in full force and effect and enforceable. The failure of either party to exercise in any respect any right provided for herein shall not be deemed a waiver of any further rights hereunder. Waiver of compliance in any particular instance does not mean that we will waive compliance in the future. In order for any waiver of compliance with these Terms of Use to be binding, TC Global must provide you with written notice of such waiver through one of its authorized representatives.

Modification of Terms of Use

TC Global reserves the right, at its sole discretion, to modify or replace any of these Terms of Use, or change, suspend, or discontinue the Service (including without limitation, the availability of any feature, database, or content) at any time by posting a notice on the Site or by sending you notice through the Service or via email. TC Global may also impose limits on certain features and services or restrict your access to parts or all of the Service without notice or liability. It is your responsibility to check these Terms of Use periodically for changes. Your continued use of the Service following the posting of any changes to these Terms of Use constitutes acceptance of those changes. You shall also be notified of any modifications to these Terms of Use as and when effected or at least once a year.

Other Provisions

Claims of Copyright or Trademark Infringement

Claims of copyright or trademark infringement should be sent to TC Global's designated agent. If you believe that someone is infringing your copyright or trademark rights on the Site, you can report it to us by contacting our designated agent at hello@thechoprasglobal.com with a report containing the following information:

Please attach your digital signature or physical signature to the report.

Within 36 hours of receiving this notice with the above mentioned details, we will take down the allegedly infringing material from public view while we assess the issues identified in your notice.

On completion of the take-down procedure above:

Before you submit a report of infringement, you may want to send a message to the person who posted the Content. You may be able to resolve the issue without contacting TC Global. Please remember, only the copyright/trademark owner or their authorized representative may file a report of infringement. If you believe something on the Site infringes someone else's copyright/trademark, you may want to let the rights owner know.

Notice

TC Global may give notice by means of a general notice on the Site / Service, notification within the mobile application on your account, electronic mail to your email address in your account, or by written communication sent to your address as set forth in your account. You may give notice to TC Global by written communication to TC Global's email address at hello@tcglobal.com or physical address at No. 3, Shenton Way, #10-05/06, Shenton House, Singapore, 068805.

General

You may not assign or transfer these Terms of Use in whole or in part without TC Global's prior written approval. You hereby give your approval to TC Global for it to assign or transfer these Terms in whole or in part, including to: (i) a subsidiary or affiliate; (ii) an acquirer of TC Global's equity, business or assets; or (iii) a successor by merger. No joint venture, partnership, employment or agency relationship exists between you, TC Global or any Third Party Provider as a result of the contract between you and TC Global or use of the Services.

If any provision of these Terms is held to be illegal, invalid or unenforceable, in whole or in part, under any law, such provision or part thereof shall to that extent be deemed not to form part of these Terms but the legality, validity and enforceability of the other provisions in these Terms shall not be affected. In that event, the parties shall replace the illegal, invalid or unenforceable provision or part thereof with a provision or part thereof that is legal, valid and enforceable and that has, to the greatest extent possible, a similar effect as the illegal, invalid or unenforceable provision or part thereof, given the contents and purpose of these Terms. These Terms constitute the entire agreement and understanding of the parties with respect to its subject matter and replaces and supersedes all prior or contemporaneous agreements or undertakings regarding such subject matter. In these Terms, the words "including" and "include" mean "including, but not limited to."

Miscellaneous

TC Global shall not be liable for any failure to perform its obligations hereunder where such failure results from any cause beyond TC Global's reasonable control, including, without limitation, mechanical, electronic or communications failure or degradation (including "line-noise" interference). These Terms of Use are personal to you, and are not assignable, transferable or sublicensable by you except with TC Global's prior written consent. TC Global may assign, transfer or delegate any of its rights and obligations hereunder without consent. No agency, partnership, joint venture, or employment relationship is created as a result of these Terms of Use and neither party has any authority of any kind to bind the other in any respect.

Unless otherwise specified in these Term of Use, all notices under these Terms of Use will be in writing and will be deemed to have been duly given when received, if personally delivered or sent by certified or registered mail, return receipt requested; when receipt is electronically confirmed, if transmitted by facsimile or e-mail; or the day after it is sent, if sent for next day delivery by recognized overnight delivery service.

Contact

You may contact us at the following address:

The Chopras Global Holdings PTE Ltd

No. 3, Shenton Way, #10-05/06, Shenton House, Singapore, 068805

Our grievance / nodal officer may be contacted at:

Zishan Siddiqui

Grievance Officer

The Chopras Global Holdings PTE Ltd

No. 3 Shenton Way

#10-05/06, Shenton House

Singapore, 068805

Email: zishans@thechoprasglobal.com

Privileged and confidential

Privacy Policy | September 6, 2021

TC Global controls, collects, owns and directs the use of the Personal Information and Usage Information on its Site and TC Global is the data controller and data processor as regards the Personal Information and Usage Information collected on its Site. For any queries regarding this Privacy Policy and the collection and use of data collected or processed under this Privacy Policy, TC Global can be contacted by mail at The Chopras Global Holdings PTE Ltd, No. 3, Shenton Way, #10-05/06, Shenton House, Singapore 068805; by phone at +65 9825 6174 or by e-mail at hello@thechoprasglobal.com.

The legal basis for collection and processing of any information collected and processed by TC Global including the Personal Information is (i) your consent at the time of providing the Personal Information; (ii) where it is in our legitimate interests to do so and not overridden by your rights (for example, in some cases for direct marketing, fraud prevention, network and information systems security, responding to your communications, the operation of networks of groups by the network administrators, and improving our Site). In some cases, we may also have a legal obligation to collect information about you or may otherwise need the information to protect your vital interests or those of another person. We may also process information to comply with a legal requirement or to perform a contract.

TC Global may ask you to provide certain categories of information such as personal information, which is information that coold reasonably be used to identify you personally, such as your name, gender, family details, address, e-mail address, nationality, details of your passport and other government ID, financial information, academic record / education history, date of birth, mobile number, travel history and medical records ("Personal Information"), when you access the Site, in order to provide you with the services requested.

Additionally, we may collect this information through various forms and in various places through the Site, including when you first register with us, when you create a transaction, when you contact us, when you update your information or from time to time or when you otherwise interact with us. TC Global may include registration, surveys, and other online forums where users will need to provide Personal Information.

First party cookies are the cookies served by the owner of the domain. In our case, that's TC Global. Any cookie we place ourselves is a "first-party cookie."

Third-party cookies are cookies placed on our domains by trusted partners that we've allowed to do so. These can be social media partners, advertising partners, security providers, and more. And they can be either "session cookies" or "permanent cookies":

Session cookies only exist until you close your browser, ending what's called your "session." Then they're deleted.

Permanent cookies have a range of lifespans and stay on your device after the browser is closed. On the Site, we try to only serve permanent cookies (or allow permanent cookies to be served by third parties) that have a limited lifespan. However, for security reasons or in other exceptional circumstances, sometimes we may need to give a cookie a longer lifespan.

Web browser cookies may store info such as your IP address or other identifiers, your browser type, and info about the content you view and interact with on digital services. By storing this info, web browser cookies can remember your preferences and settings for online services and analyze how you use them.

Along with cookies, we also use tracking technologies that are very similar. Our Site may contain small transparent image files or lines of code that record how you interact with them. These include "web beacons," "scripts," "tracking URLs," or "software development kits" (known as SDKs):

Web beacons have a lot of different names. They might also be known as web bugs, tracking bugs, tags, web tags, page tags, tracking pixels, pixel tags, 1x1 GIFs, or clear GIFs. In short, these beacons are a tiny graphic image of just one pixel that can be delivered to your device as part of a web page request, in an app, an advertisement, or an HTML email message. They can be used to retrieve info from your device, such as your device type, operating system, IP address, and the time of your visit. They are also used to serve and read cookies in your browser or to trigger the placement of a cookie.

Scripts are small computer programs embedded within our web pages that give those pages a wide variety of extra functionality. Scripts make it possible for the website to function properly. For example, scripts power certain security features and enable basic interactive features on our website. Scripts can also be used for analytical or advertising purposes. For example, a script can collect info about how you use our website, such as which pages you visit or what you search for.

Tracking URLs are links with a unique identifier in them. These are used to track which website brought you to the Site. An example woold be if you clicked from a social media page, search engine, or one of our affiliate partners' websites.

Software Development Kits (SDKs) are part of our apps' source code. Unlike browser cookies, SDK data is stored in the app storage. They're used to analyze how the apps are being used or to send personalized push notifications. To do this, they record unique identifiers associated with your device, like your device ID, IP address, in-app activity, and network location.

All these tracking technologies are referred to as "cookies" here in this Cookie Statement.

However, no Personal Information identifying the user is collected nor any data capture mechanisms are employed. The user may change browser settings to accept or reject cookies on personal preference. You have the ability to accept or decline cookies. Most web browsers automatically accept cookies, but you can usually modify the browser setting to decline cookies if you so prefer. If you choose to decline cookies, you may not be able to sign in or use other interactive features of the Site that may depend on cookies. If you choose to accept cookies, you also have the ability to later delete cookies that you have accepted. If you choose to delete cookies, any settings and preferences controlled by those cookies, including advertising preferences, will be deleted and may need to be recreated. We process and keep all data for our own use and, if you wish to opt-out from tracking by TC Global you can do so at hello@thechoprasglobal.com

TC Global may also process any Personal Information or Usage Information collected from you for legitimate commercial purposes including to provide you with the requisite information requested. A list of uses of the Personal Information and Usage Information collected is provided at Section 3 of this Policy (Use of Information Collected).

TC Global implements appropriate technical and organisational measures to ensure a level of security appropriate to the risk of our processing of information about individuals such as (i) only sharing and providing access to your information to the minimum extent necessary, subject to confidentiality restrictions where appropriate, and on an anonymised basis wherever possible; (ii) using secure servers to store your information; (iii) verifying the identity of any individual who requests access to information prior to granting them access to information; and (iv) using Secure Sockets Layer (SSL) software or other similar encryption technologies to encrypt any payment transactions you make on or via our Site.

Any user who has submitted Personal Information on the Site has the right to (i) access, correct, delete such Personal Information subject to us successfolly verifying your identity; (ii) object to us processing your Personal Information on legitimate grounds; (iii) to withdraw your consent to our use of your information at any time where we rely on your consent to use or process that information; (iv) opting out of receiving any promotional or marketing material by clicking on the "Unsubscribe" button or by sending an email to [hello@thechoprasglobal.com]. Please note that if you withdraw your consent, this will not affect the lawfolness of our use and processing of your information on the basis of your consent before the point in time when you withdraw your consent; (v) right to have the Personal Information transferred to another data controller; and (vi) lodge a complaint with a supervisory authority, in particolar in the jurisdiction of your habitual residence, place of work or of an alleged infringement of any applicable data protection laws. Any request received by us by the user in relation to the aforesaid shall be acknowledged by us within seventy-two (72) business hours.

TC Global does not share any Personal Information with any third party without your consent, except when directed by the law. TC Global can use this data to verify user identity in line with engagement initiated by the user. We will communicate with you using the contact information provided by you in order to respond to any queries that you may have and to provide any information that you may request regarding the services provided through the Site. We may communicate with you either by written, physical communication, email, telephone, SMS or via notifications on your mobile device. We may also send strictly service-related announcements to you periodically and when it is necessary to do so. For instance, if our services are temporarily suspended for maintenance, we might send you an email, text message, flash notification or telephone call. If you do not wish to receive such alerts, you have the option to unsubscribe from such emails or opt out by sending an email to hello@thechoprasglobal.com.

We may use Personal Information or Usage Information collected through the Site in the following ways:

We may share non-Personal Information, such as aggregated user statistics and log data, with our business partners for industry analysis, demographic profiling, to deliver targeted advertising about other products or services, or for other business purposes. This information is solely used to analyze company Site and understand usage statistics, as mentioned above, is anonymous. The company may share this data with its business partners on anonymous basis. We do not sell, share, rent or trade the information we have collected about you, including Personal Information, other than as disclosed within this Privacy Policy or at the time you provide your information. We do not share your Personal Information with third parties for those third parties' direct marketing purposes unless you consent to such sharing at the time you provide your Personal Information.

We cooperate with government and law enforcement officials and private parties to enforce and comply with the law. Thus, we may access, use, store, transfer and disclose your information (including Personal Information), including disclosure to third parties such as government or law enforcement officials or private parties as we reasonably determine is necessary and appropriate: (i) to satisfy any applicable law, regolation, governmental requests or legal process; (ii) to protect the safety, rights, property or security of TC Global, our services, the Site or any third party; (iii) to protect the safety of the public for any reason; (iv) to detect, prevent or otherwise address fraud, security or technical issues; and /or (v) to prevent or stop any activity we consider to be, or to pose a risk of being, an illegal, unethical, or legally actionable activity. Such disclosures may be carried out without notice to you.

We may share your information, including your Personal Information and Usage Information with our parent, subsidiaries and affiliates for internal reasons. We also reserve the right to disclose and transfer all such information: (i) to a subsequent owner, co-owner or operator of the Site or applicable database; or (ii) in connection with a corporate merger, consolidation, restructuring, the sale of substantially all of our membership interests and/or assets or other corporate change, including, during the course of any due diligence process. You will be notified via email and/or a prominent notice on our Site of any change in ownership or uses of your personal information, as well as any choices you may have regarding your personal information. We will endeavor that the transferee who is the recipient of Personal Information and Usage Information commits to privacy measures which are substantially similar to the measures under this privacy policy.

We do not include or offer third party products or services on our Site.

Your information may be stored and processed in Singapore or any other country in which TC Global or its subsidiaries, affiliates or service providers maintain facilities. TC Global may transfer information that we collect about you, including Personal Information, to affiliated entities, or to other third parties across borders and from your country or jurisdiction to other countries or jurisdictions around the world. These countries may have data protection laws that are different to the laws of your country and, in some cases, may not be as protective. We have taken appropriate safeguards to require that your information will remain protected in accordance with this Privacy Policy by entering into requisite agreements with the concerned transferees.

Your information will be retained with TC Global as long as it is needed by TC Global to provide services to you. If you wish to cancel your account or request that TC Global no longer uses your information to provide services, you may contact TC Global at hello@tcglobal.com.. TC Global will promptly delete the information as requested. TC Global will retain and use your information as necessary to comply with its legal obligations, resolve disputes, and enforce its agreements or for other business purposes. When TC Global has no ongoing legitimate business need to process your information, we will either delete or anonymize it.

In case on any queries on this privacy policy, please contact us at hello@thechoprasglobal.com. TC Global reserves the right to update or modify any part of this policy or make any changes without prior notice to the user. The user is advised to check this page periodically to stay abreast of any policy changes by us.

You are responsible for maintaining the accuracy of the information you submit to us, such as your contact information provided as part of account registration. If your Personal Information changes, or if you no longer desire to access the Site, you may correct, delete inaccuracies, or amend information by contacting us through hello@tcglobal.com and we will respond within 72 hours of receipt of communication.

You have the right to request that we rectify or delete the personal data or restrict the processing of your personal data, if you think they are inaccurate. Furthermore, you have the right to object against the processing based on our legitimate interests as a legal basis. We are required to assess and act on your request. Additionally, you also have the right to data portability if it shoold become relevant. You have a right to lodge a complaint with your local supervisory authority.

[You may also cancel or modify your communications that you have elected to receive from the Site by logging into your user account and changing your communication preferences.

If you wish to cancel your account or request that we no longer use your information to provide you details with respect to our services and the Site, please write to us at hello@tcglobal.com.

If you wish to opt out of receiving non-essential communications such as promotional and marketing-related information regarding the Site and our services, please send TC Global an email at hello@tcglobal.com.

From time to time, we may update this Privacy Policy to reflect changes to our information practices. Any changes will be effective immediately upon the posting of the revised Privacy Policy on the Site. If we make any material changes, we will notify you by email (sent to the e-mail address specified in your account) or by means of a notice on the Site prior to the change becoming effective. We encourage you to periodically review this page for the latest information on our privacy practices.

If you have any questions or concerns about this Privacy Policy, please feel free to contact us by writing to us at hello@thechoprasglobal.com or using the details provided on our 'Contact Us' page. We will use reasonable efforts to respond promptly to requests, questions or concerns you may have regarding our use of personal information about you. Except where required by law, TC Global cannot ensure a response to questions or comments regarding topics unrelated to this policy or Company's privacy practices.

By consenting to the terms under this Privacy Policy, you are expressly granting TC Global the right to collect, share, transfer, store, retain, disseminate or use the Personal Information/Usage Information collected by TC Global from your usage of the Site in accordance with the terms of the Privacy Policy. You may, at any time, withdraw consent for the collection or processing of Personal Information/Usage Information by sending an email to hello@tcglobal.com. TC Global, shall within 72 hours delete or anonymize the data collected from you.

If you have any questions about this Privacy Policy, please contact us:

By email: hello@thechoprasglobal.com

In the event of any grievances, user can contact the grievance officer at zishans@thechoprasglobal.com or write to us at the following address:

Zishan Siddiqui

Grievance Officer

The Chopras Global Holdings PTE Ltd

No. 3 Shenton Way

#10-05/06, Shenton House

Singapore, 068805

Hey it looks like you've already got an account with us.

Sign into your Portal to e-meet with us!

We're now directing you to our scheduling service to pick an e-meet slot. We look forward to starting our journey together!

Hey it looks like you've already got an account with us.

Sign into your Portal to e-meet with us!

We will contact you shortly and together

we will focus on your journey.

loading...